In today’s world, mobile is king – and your business should reflect that. User Increase should be on the forefront of your marketing strategy.

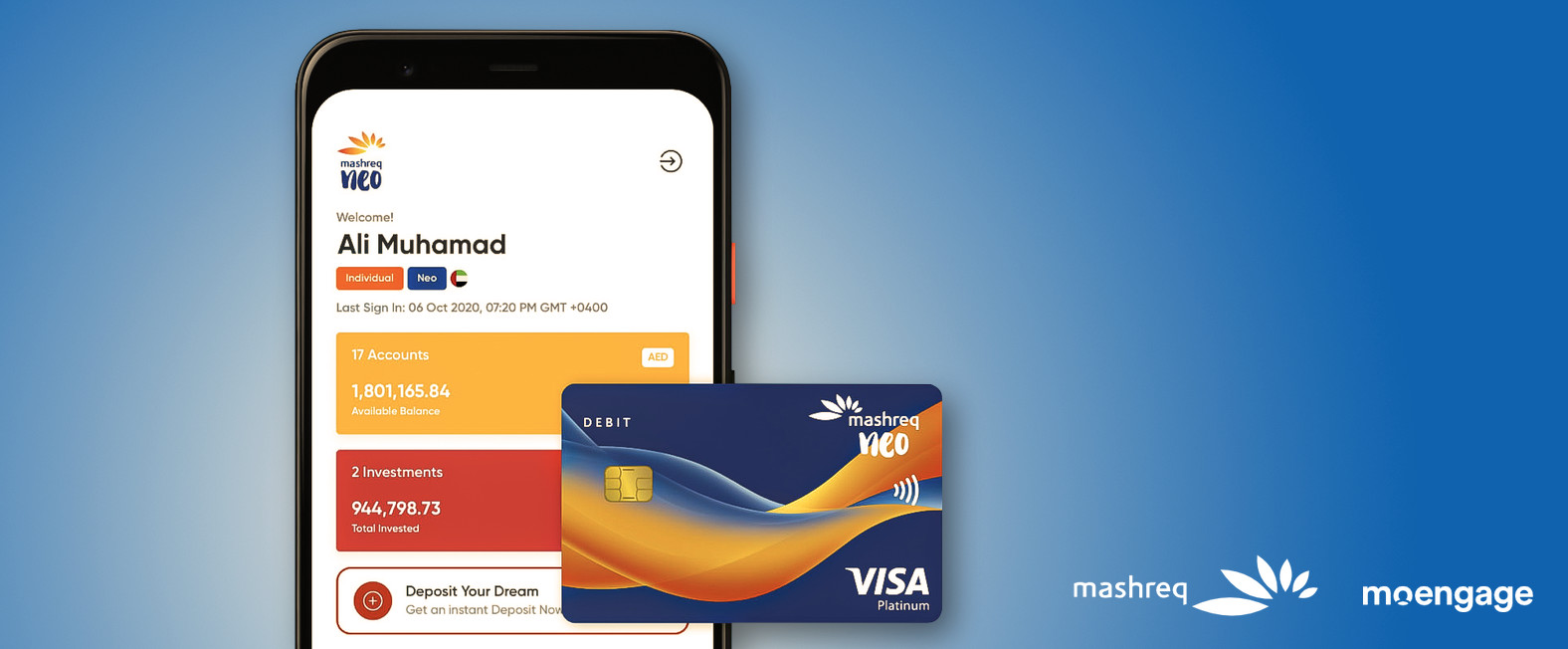

Learn how Mashreq, one of leading financial institutions in the UAE, made their digital banking app the center of their customer experience, and saw a sharp 9k month-to-month user increase.

The Problem

Mashreq’s digital banking app, Mashreq Neo, was not integrated into the larger omnichannel customer experience. As a result of this, customer data was stored in silos – which made it challenging to acquire a 360 customer view and deliver a quality customer experience.

The Mashreq Neo team noticed that their engagement was affected, especially when it came to adoption rates on key features such as debit card spends.

The team established several major objectives:

- User increase / customer onboarding

- Boost debit card adoption and spending

- Improve loyalty program consumption

The marketing team needed a Customer Data Platform that could help them handle fresh, first-party customer data, to regain some of their lost momentum.

Solution

Instead of treating their app as just another touchpoint in their customers’ journey, Mashreq decided to place Mashreq Neo at the center of the customer journey.

To achieve this, Mashreq would need a powerful customer engagement engine, which could help them perform behavioral analysis and optimize personalized messaging.

After evaluating several different customer engagement platforms, the Mashreq Neo team decided on MoEngage as their solution of choice.

The Results: User Increase

With MoEngage’s features such as Cohort Analytics and Sherpa, Mashriq Neo was able to implement a comprehensive contextual app engagement strategy.

This strategy brought them:

- 9K month-on-month new mobile app user increase

- 50% increase in CTR using personalization and AI

- 16% boost in debit cards activation

With MoEngage’s Cohort Analytics, Mashriq Neo’s team was able to map out their customer journey in fine detail and identify and address major drop-off points.

To elevate their messaging, the team looked at performance data of their past messages and took action to align their mode of communication with the right channel and audience – user increase by delivering a superior digital banking experience to Mashriq Neo’s users.